Today’s post will be quick and short. The market displayed its bi-polar nature today and ended the day with something like a bearish reversal candle. This is the reason I keep telling that if you are in investor and not a day trader, you are well advised to give the rally a miss. Again, this behavior is completely expected because this is a counter trend rally and it is bound to fail anytime. It reached my 1st target which is 1330 and reversed from there. Is the rally over? Somehow I do not think so. I think it still has few more days of fuel left and we may see the uptrend resumed tomorrow.

I am holding QQQ, Crude and Gold ETFs and I do not like the price action in Gold one little bit. As I wrote yesterday, I will see how it goes for few more days and then go out of it. However, intraday, it touched $ 1580 and bounced from there. On a weekly chart of GLD, we see that while it is below the long term trend line, for last three weeks it has touched 3 standard deviation on the lower end. The rubber band is too much stretched on one side and it may as well snap back.

So I will hold it till early next week to see where it goes. I have a longer term target of $ 2500/oz for gold but a good entry will be very helpful.

Crude on the other hand is a different story. My longer term target for Crude is $ 70 and so this is just a counter trend play from oversold position. It reached $ 87 intraday today and I should have gone out of it then. Let us see what happens tomorrow.

Euro and SPX is moving hand in hand like a love struck teenage couple.

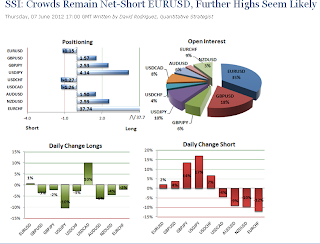

But the short position in Euro is humongous and is a contrarian indicator. The Speculative Sentiment Index (SSI) of FXCM shows that crowed remains net short in Euro/ USD and further gain in Euro is likely.

That is one reason I think we will see more highs in the equities, at least in the short term.

That’s all I have time for today. Thanks for reading http://bbfinance.blogspot.com/. Please forward / re-tweet / post it on your wall and join me in twitter. (Twitter @ BBFinanceblog)(Stocktwits: Worldoffinance)