From 1422 we came down to 1358 in 5 days. That is about 5% correction which I was hoping for end of March. But even with this small correction we are in oversold territory. How can we hope for a good shake down when we have tripped just out of the gate? That is the reason I am not going short yet. I would like to see a complete trend change lined up with all other parameters, which we do not have. And I am not getting a price target for correction either.

The longer term cycle tops next week which is also Op-Ex week. The week of Op-Ex is generally a bullish week. As per Stock Trader’s Almanac, on the 1st trading day of the expiration week, DOW is up 15 of the last 22 and on income tax deadline day, DOW has been down only 5 times since 1981. Past is of course no guarantee of the future, but given the fact that we are in oversold region, and indexes generally try to re-test their earlier top before rolling over, it seems likely that the markets will give another try.

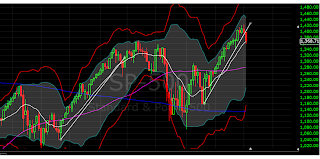

By no means am I suggesting going long or shorting. I would rather be on the sideline now, if you had some nice profit so far. Because cash is also a position. May be we can take a short position in the 4th week of April but let us 1st see through the next 4/ 5 trading days and let us see how it goes. One definite indicator of market weakness would be if the indexes fail to make new high. Let’s look at SPX weekly chart.

Almost similar like last year around same time.

Because of the other work commitments, I will have to change my trading style. Going forward, I would be looking to trade as little as possible. Just identify bigger trends and go with that. Other times stay out of the market.

I think for the year 2012, bears will be disappointed. This will be the year when indexes will reach the previous highs and most likely exceed it before going downhill in 2013, 2014. When that move starts and from where it starts, is something I will be watching and waiting for.

SPX monthly Chart.

Thank you for reading http://bbfinance.blogspot.ca/